Queen Street Corridor

AEDP GrantsQueen Street Corridor Grants

At the end of March 2022, the Queen Street Business Corridor Grant Program was finalized with 21 community-serving businesses receiving $5,000 grants to support their ongoing recovery and long-term resiliency.

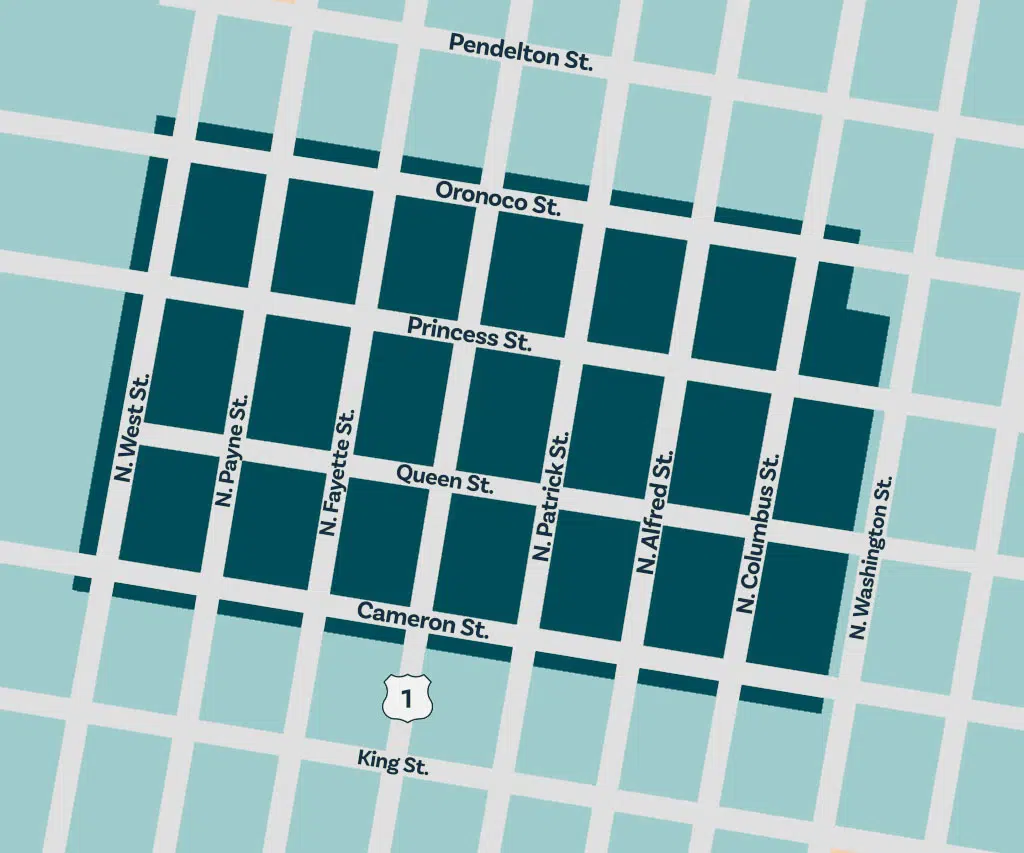

This initiative is one part of a larger effort by the Alexandria Economic Development Partnership (AEDP), Department of Planning & Zoning (P&Z), and other community partners to engage and support small business owners in the Queen Street Business Corridor (see map below).

This one-time grant program was funded through an allocation made by City Council from the Braddock Community Amenities Fund – a special fund created by City Council to support the implementation of the Braddock Metro Neighborhood Small Area Plan. A key component of that plan is the preservation and expansion of community-serving small businesses.

Eligible businesses had to be located within the dark blue area on the map.

Awardees

- 1201 Queen Street

- All American Barbershop

- American Day School 1, 2, and 3

- Bright Minds Daycare

- C&C Hair Studio

- Citrus Club Cosmetics

- CrossFit NBHD

- Free Space

- Hawwi Ethiopian Restaurant

- Heads Up Barbershop

- Hopkins House

- Image Hair Station

- Not Just Hair

- Old House Cosmopolitan Grill

- Parker Gray Pediatric Dental Care

- Salon Meraki

- sclup’d

- TLC Design

- Zweet Sport

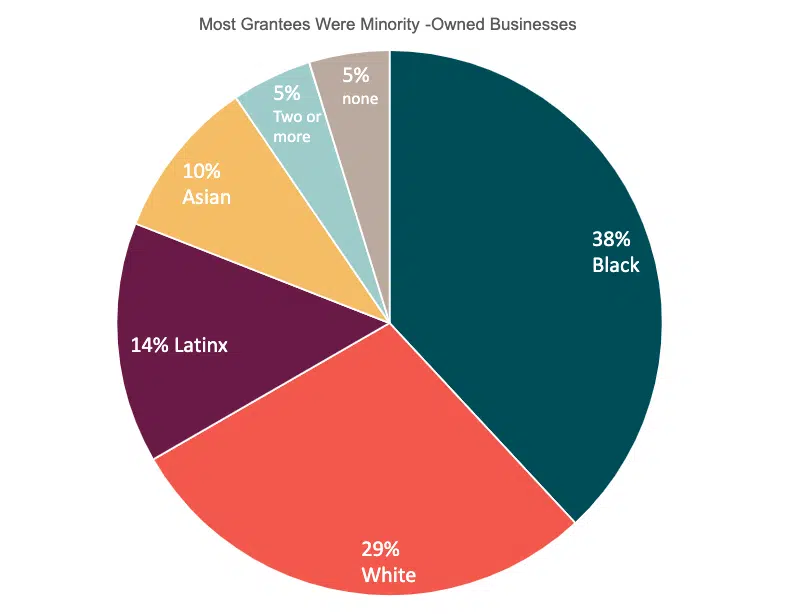

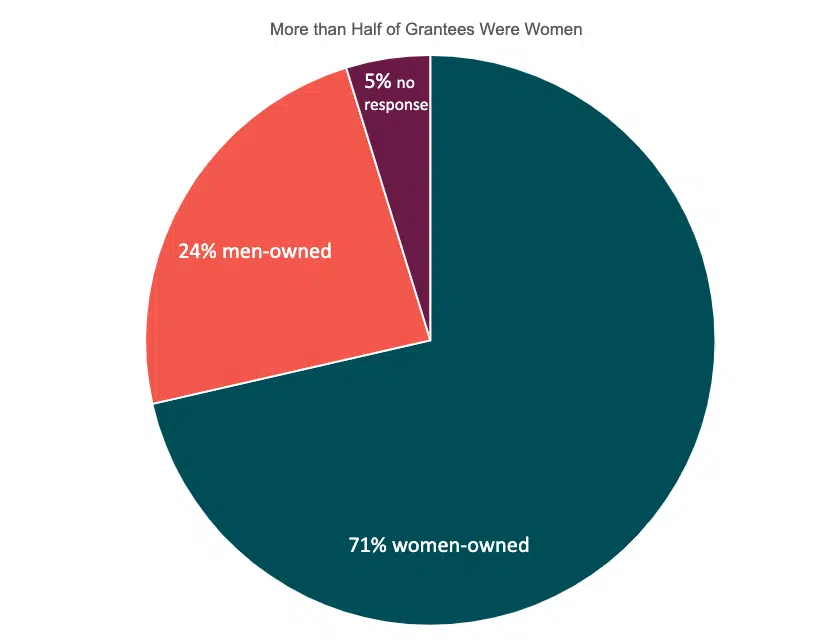

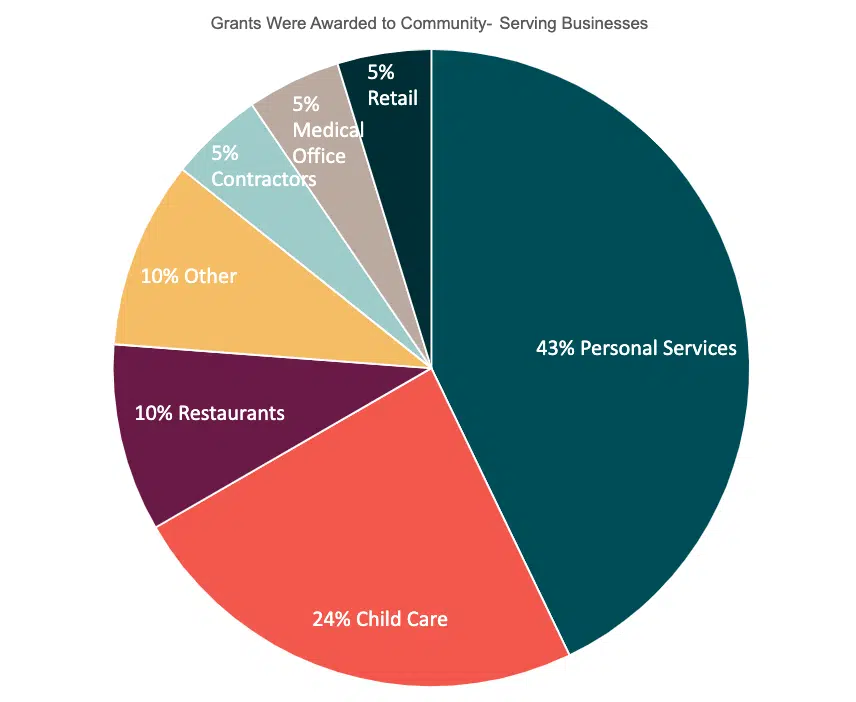

Demographics

Eligibility

To qualify, businesses had to be:

- Licensed in the City of Alexandria

- Located within the designated Queen Street corridor (see map below), defined as N. Columbus Street to N. West Street (East to West) and Cameron Street to Oronoco Street (South to North).

- A for-profit small business defined as a Retail Shop, Restaurant, Personal Service (i.e., barbers, salons, etc.), Repair Service, Contractor (i.e., handyman, carpenter, etc.) or Medical Office, OR any entity (for-profit or nonprofit) that provides full-day or part-day childcare services to children 0-13 years of age and is licensed or regulated by a local ordinance or state licensing body

- Current on all local business taxes or on a payment plan with the City

- Not currently involved in business bankruptcy proceedings

- Between 0 – 100 employees

- Locally owned and operated

Approved Uses

- Business Operations – includes ongoing and/or deferred rent and utility payments.

- Business Resiliency – investments to support the long-term profitability of the business in the areas of:

- Marketing & Promotion – professional services related to the development and implementation of marketing strategies to attract customers through increased brand awareness.

- Technology Enhancements – the purchase of technology to facilitate e-commerce and/or vital business operations.

- Professional Services / Business Consultants – to procure services to assist with business planning, operations, and other business needs (i.e., accountants, lawyers, etc.).

- Equipment Replacement & PPE – the replacement and/or upgrading of business equipment, including the purchase of Personal Protective Equipment (PPE).

- Interior Space Improvements – includes furniture and fixtures and professional services related to the design and construction/alteration of the business’s built environment, as well as the actual costs for alterations.

Grant funds must be spent before June 30, 2022.

Grant funds may not be used for:

- Payroll expenses, and

- Local, state, or federal taxes.